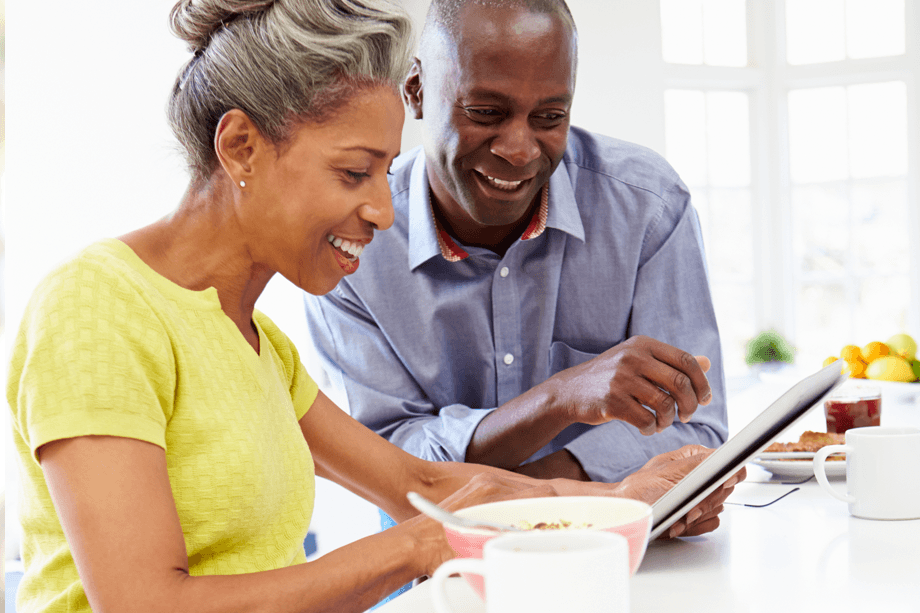

Your money on the go

Create savings goals, check your credit score, send money with Zelle®, set up activity alerts, and it’s all at your fingertips through Grand.bank’s Mobile App.*

Download it today!

Your money works for you

- Earn competitive interest rates.

- CDs, Money Markets, savings options to fit your budget.

Safe and sound

Grand.bank is a trademark of Grand Bank for Savings, FSB. Member FDIC. Therefore, your money is safe, and sound and your information is secure with Grand.bank for that extra peace of mind.

40,000 surcharge-free ATMS

Wherever you may roam, you can travel with ease knowing you have access to your money. Find MoneyPass ATMs near you. |

Giving Back to Our Community

Community is at the heart of everything we do. We are proud to partner with local communities and nonprofits through our Giving Back Program, where we foster a culture of generosity and community engagement. We encourage our associates to dedicate their time to incredible charities and nonprofits that matter and we support them with a corporate PTO Match program. Together, we create “GRAND” moments and drive positive change in our communities.

*Mobile carrier determines mobile access; message/data rates may apply.